.jpg?w=1140)

March Snapshot

These figures are exclusively for the Oakville residential market and although all information provided is deemed accurate it is not guaranteed.

The average sale price is found by adding the value of all sales and divided by the number of homes sold. The median sale price is the midpoint sales price of all sales. The variance between the median and the average is primarily accredited to the high price point of the multiple luxury sales in Oakville for the month. A few $5 million plus sales can skew the calculation upward.

These stats do not include sold properties not reported through the Oakville, Milton and District Real Estate Board. For example, a home listed and sold by a Toronto Real Estate Board member who did not list the property on the Oakville board. I know sounds crazy right...who would ever do that and forego the massive exposure to Oakville realtors? Shockingly, it happens.

See further down for our more in depth "Under the Hood" look at the numbers.

Hot New Listings...

Royal LePage National House Price Survey Q1/2019

.jpg?w=610)

According to the Royal LePage House Price Survey (see link below for entire article), Canada’s residential real estate market showed slowing year-over-year price growth in the first quarter of 2019.

Early in 2018, Canada experienced the most significant housing correction since the 2008 financial crisis. Markets showed signs of recovery late in the year, yet the figures for early 2019 suggest that the market has once again slowed.

The Royal LePage National House Price Composite, compiled from proprietary property data in 63 of the nation’s largest real estate markets, showed that the price of a home in Canada increased just 2.7 per cent year-over-year to $621,575 in the first quarter of 2019, well below the long-term norm of approximately 5 per cent. When broken out by housing type, the median price of a two-storey home rose 2.6 per cent year-over-year to $729,553, while the median price of a bungalow rose 1.1 per cent year-over-year to $513,497. Condominiums remained the fastest growing housing type on a national basis, rising 5.4 per cent year-over-year to $447,260.

Looking ahead to the second quarter, Royal LePage expects national home prices to stay relatively flat throughout the 2019 spring market, with the national aggregate price of a home increasing 1.0 per cent over the next three months. Meanwhile, the housing markets in several larger Canadian cities have shown noticeable signs of slowing, with nearly half of the regions in Royal LePage’s Quarterly Forecast[2] anticipating quarter-over-quarter price declines. Notably, Royal LePage is expecting home prices in Greater Vancouver to fall 1.4 per cent over the next quarter. Ottawa is expected to post the highest price appreciation during the spring market and is forecast to rise 2.8 per cent to $482,459 during the second quarter.

“We are expecting this to be a sluggish year overall in Canada’s residential real estate market, with the hangover from the 2018 market correction and weaker economic growth acting as a drag on home price appreciation, balanced by lower for longer interest rates,” said Phil Soper, president and CEO, Royal LePage. “There is a silver lining here. This slowdown gives buyers, and first-time buyers in particular, an opportunity to buy real estate in our country’s largest cities.”

The global economy hit a soft spot entering the new year. The economic downturns in China and Germany, ongoing trade disputes, and slowing U.S. growth support a relatively muted global outlook. The upside for the Canadian housing market is the increased likelihood that interest rate hikes are on hold for the foreseeable future.

“Canada is certainly affected by negative global macroeconomic trends, yet full-time job creation in our country is very strong, and full-time employment turns renters into buyers,” said Soper. “The medium-term outlook for housing remains very positive.”

In the federal budget tabled by Finance Minister Bill Morneau in March, the Canadian government announced three new or enhanced housing programs. The First-Time Home Buyer Incentive is a three-year, $1.25 billion shared equity mortgage program whereby the Canadian Housing and Mortgage Corporation (CMHC) will co-invest up to five per cent of the purchase price of an existing home. Further, for the first time in a decade, there was an increase in the registered retirement savings plan withdrawal limits in the Home Buyers Plan. The increase, from $25,000 to $35,000, was the largest since the program’s inception in 1992. Finally, an additional $10 billion in financing over nine years was earmarked for the construction of purpose-built rental housing.

Some critics believe that the narrowly focused federal housing initiatives will overstimulate already expensive markets. We disagree. Eroding affordability risks taking the dream of home ownership away from young Canadian families,” said Soper. “Without a healthy influx of first-time buyers, the entire cycle of real estate activity can stall. There is the chance, however, that activity levels in the spring of 2019 will be reduced as some delay purchases, waiting for the First-Time Home Buyer Incentive to kick-in.”

Driven by supply-side shortages, and augmented by an improving job market, home price appreciation in Ontario heavily influenced the national results in the first quarter of 2019. If Ontario is excluded from the Royal LePage National House Price Composite, Canadian price appreciation would sit at a modest 0.4 per cent increase compared to 2.7 per cent.

“The City of Toronto is still one of Canada’s fastest appreciating real estate markets,” said Soper. “Detached home prices are rising in line with inflation, but condominium prices are increasing at near double-digit levels as vertical living has become the primary new-build option in this growing, world-class city.”

Median home prices in the City of Toronto rose 5.8 per cent year-over-year in the first quarter of 2019. Two-storey home prices and bungalow home prices rose 4.8 per cent and 2.5 per cent year-over-year, respectively, while condo prices rose a weighty 9.3 per cent year-over-year. The overall GTA’s aggregate home price rose 3.4 per cent over the same period.

As always, if you have any question or real estate needs, please don't hesitate to contact us.

Blair & Peter

A Few of Our Recent Solds...

$2,295,000 SOLD!!

Oakville Town Talk

You may have seen the We Love Oakville signs as you walk/drive around town. What are they about? Here's a quick breakdown of the facts:

Province of Ontario has announced a review of 8 regional municipalities including Halton, to ensure they are working effectively and efficiently. They are proposing amalgamating Oakville, Milton, Burlington and Halton Hills into the City of Halton. The consequences would be the loss of the two-tier government model that controls our public transit, fire department, zoning, parks, trails and community centres just to name a few. Most are in agreement that having access to local politicians is essential for its citizens. Each area has its unique needs, priorities and do we want the provincial government to tell us what is best for us? The one size fits all approach cannot represent everyone's varied interests. We love our Town and do not think amalgamation serves the interests of our communities. Please email us at [email protected] if you would like to have a lawn sign delivered.

We encourage you to send a letter to your local MPP and support the campaign.

website: weloveoakville.org

Our "Under the Hood" Look at the Numbers

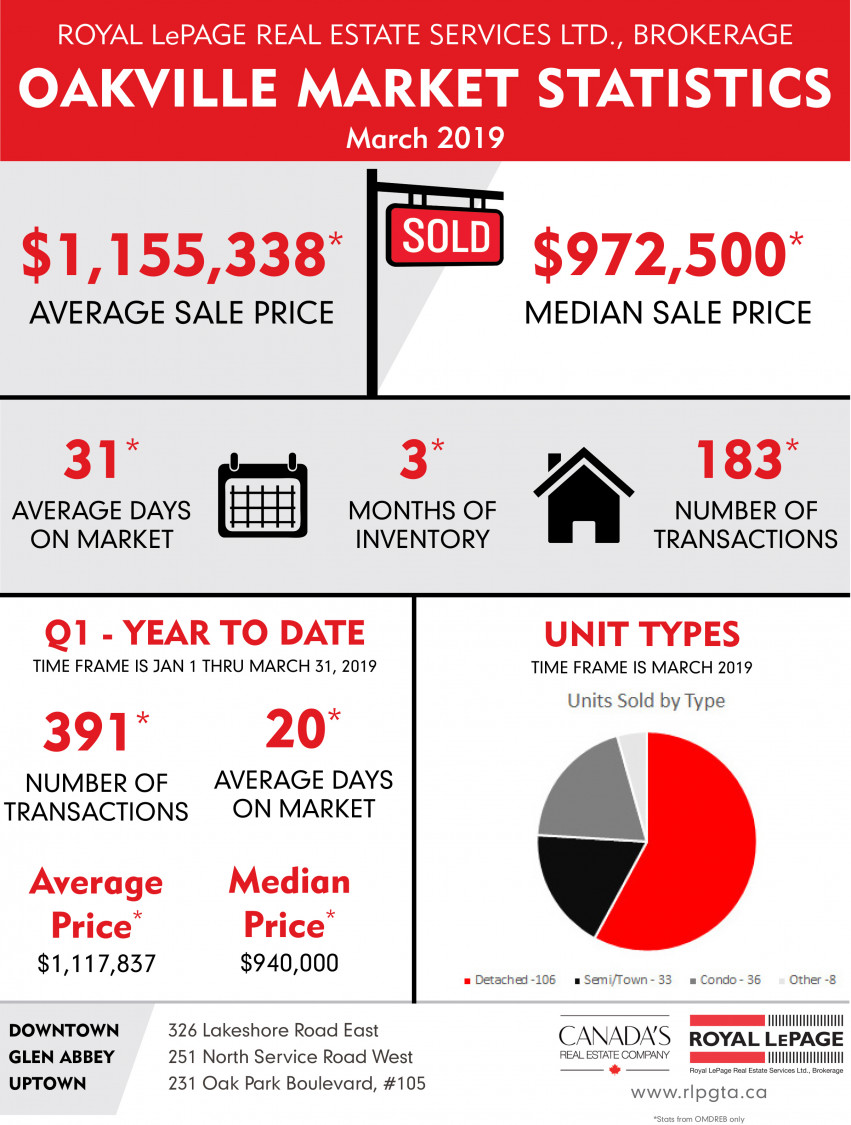

Median Sale Price

Mar 2019

$972,500 (-4.66%)

Mar 2018

$1,020,000

Mar 2019 YTD

$940,000 (-0.53%)

Mar 2018 YTD

$945,000

Average Sale Price

Mar 2019

$1,155,338 (+4.64%)

Mar 2018

$1,104,071

Mar 2019 YTD

$1,117,837 (+1.59%)

Mar 2018 YTD

$1,100,307

Number of Sales

Mar 2019

183 (-17.19%)

Mar 2018

221

Mar 2019 YTD

391 (-20.37%)

Mar 2018 YTD

491

Toronto Sales

Average Sale Price

$788,335 (+.5%)

Number of Sales

7,187 (0%)

Days on Market

21 (+5%)

Need More Info?

If you have any questions about the content of our newsletter, require information on a particular property or are interested in having a free no obligation price evaluation of you home, please email us directly or click below

Contact Us